Beyond Data Aggregation:

Complete Due Diligence

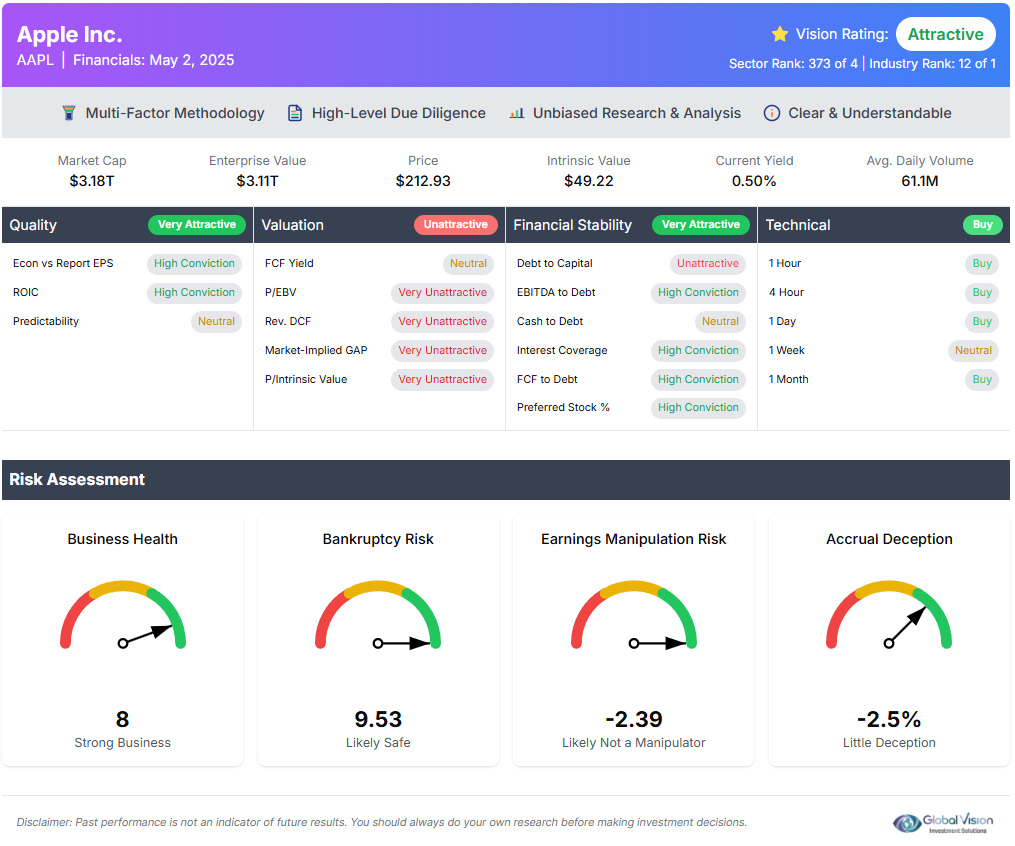

Our Robo Analyst transforms complex market data into clear, actionable investment insights through our proprietary multi-factor methodology.

- Backed by peer-reviewed research

- Evidence-based methodology

- 7-day free trial

- 30-day money-back guarantee

- Expert financial analysis team

- No hidden fees

Transforming Investor Decision-Making Through Innovation

Our Innovation, Your Advantage: Our mission is not just about data transformation; it's about empowering our users to make smarter, more confident decisions.

Real-Time, Actionable Intelligence

Our advanced Robo Analyst continuously processes and integrates vast amounts of market data, delivering insights in real time. This allows investors to identify and act on breakthrough opportunities as they emerge.

Holistic Analysis for Informed Decisions

By integrating technical, fundamental, and valuation perspectives into a single, unified dashboard, our platform simplifies complex data. Investors gain a comprehensive view of market dynamics.

Enhanced Clarity and Confidence

Our streamlined, user-centric design transforms overwhelming market data into clear, digestible insights. This clarity builds investor confidence, helping users make well-timed, decisive moves.

Tailored Insights for Strategic Advantage

Customizable dashboards and interactive tools allow users to focus on the metrics that matter most to their specific strategies, ensuring every investor can harness the information that drives superior returns.

How VISION Drives Our Investment Approach

Every aspect of our analysis is powered by the VISION framework - six core principles that transform complex market data into clear, actionable investment insights.

Velocity

Rapid analysis and execution to capitalize on market momentum

Inflection

Identification of critical market turning points that signal breakthrough opportunities

Synergy

Seamless integration of fundamental, valuation, and technical analysis to create powerful insights

Insights

Clear, actionable intelligence that empowers confident decision making

Optimization

Maximizing returns and efficiency to ensure every action is strategically sound

Navigator

Guiding investors through complex global markets with clarity and precision

Distinctive Research Integration: Our Competitive Edge

Our Unique Approach Sets Us Apart: Global VISION redefines investment research with a distinctive process that transforms raw data into a unified, actionable framework.

Seamless Data Synthesis

Our proprietary triple lens process harmonizes multiple data streams into one cohesive narrative, eliminating the need for investors to toggle between disparate tools.

Empirical Rigor with Cutting-Edge Technology

Powered by our advanced Robo Analyst, our platform leverages quantitative methods backed by academic research to pinpoint high-value opportunities.

User-Centric Design for Streamlined Analysis

We prioritize ease of use by embedding complex analytical processes within an intuitive, customizable interface for both novice and expert investors.

Dynamic, Real-Time Updates

Continuous monitoring of global markets ensures that our analysis is always current, providing investors with the timeliness needed to capitalize on market shifts.

Higher returns than traditional analysts

Securities analyzed globally

Average return improvement with integrated approach

Continuous market monitoring

Our Core Values

Six fundamental principles that guide every aspect of our research and platform development.

Precision

Delivering rigorous, integrated research that fuels every pillar of our process

Integration

Harmonizing diverse data streams into unified, actionable insights

Trust

Providing transparent, clear recommendations that investors can rely on

Timeliness

Utilizing real time data to ensure no opportunity is missed

Innovation

Constantly evolving our approach to capture emerging market opportunities

Simplicity

Turning complex global data into clear, actionable strategies

Research-Backed Methodology

Our investment approach is grounded in peer-reviewed academic research, delivering proven strategies that consistently outperform traditional methods.

Quality Factor

Selecting financially strong stocks significantly increases returns while reducing downside risk.

The mean return earned by a high book-to-market investor can be increased by at least 7.5% annually through the selection of financially strong firms...

Robo-Analyst Advantage

Research shows that AI-powered analysis outperforms human analysts by eliminating bias and processing vast amounts of data consistently.

Portfolios formed on Robo-Analysts' buy recommendations earn abnormal returns that are statistically and economically significant...

Integrated Analysis

Combining technical, fundamental, and valuation analysis doubles returns compared to single-factor approaches.

The integrated approach that combines fundamental and technical information earns much higher average returns...

Value & Momentum Synergy

The negative correlation between value and momentum strategies creates a more efficient portfolio with higher Sharpe ratios and nearly doubled monthly returns.

In every market, the value/momentum combination outperforms either value or momentum by itself...

Choose Your Investment Research Plan

Professional-grade research tools designed for every type of investor, from individuals to institutions.

Essential Plan

Perfect for investors getting started with professional-grade research

Premium Plan

Comprehensive research platform for serious investors

Professional Plan

Complete solution for financial advisors and institutions

Enterprise

Custom solutions for large organizations and teams